Managing payroll efficiently is crucial for small businesses to ensure accurate compensation for employees and contractors while complying with tax regulations. This article highlights the top payroll services for small businesses, each offering unique features to streamline payroll and HR processes.

1. OnPay: Simplified Payroll and HR Solution

OnPay presents itself as an uncomplicated, all-encompassing payroll and HR solution suitable for small businesses. Priced competitively at $40 plus $6 per employee per month, OnPay’s inclusive package covers an array of services.

Key Features of OnPay:

- Payroll management for both W-2 and 1099 workers

- Automatic tax payments and filing

- Employee self-service portal for onboarding, document management, and PTO tracking

- Access to benefits administration, including insurance and retirement plans

- Integration with popular HR and accounting tools such as QuickBooks, Xero, and When I Work

Who Should Choose OnPay: OnPay caters to a diverse range of small businesses, from startups and entrepreneurs to local shops, nonprofits, religious organizations, and farm owners.

Pros:

- Transparent and comprehensive pricing

- Streamlined employee and contractor payroll processing

- Integrated HR and benefits management

Cons:

- Absence of a free trial

- Limited plan customization options

READ MORE:

2. Gusto: Tailored for Startups and Small Businesses

Gusto stands out as an ideal choice for dynamic startups and small businesses, offering specialized solutions not typically found on other platforms.

Key Features of Gusto:

- Automated payroll processing for employees and contractors

- Dedicated AutoPilot payroll software

- Employee benefits administration including health care and retirement plans

- Wallet app for enhanced financial control for employees

Who Should Choose Gusto: Gusto is designed for startups and growing small businesses aiming to automate business processes, reduce administrative workload, and focus on core operations.

Pros:

- Efficient employee and contractor payroll processing

- Automated tax filing and compliance guidance

- Integrated checking and savings accounts for employees

Cons:

- Increasing costs at scale

- Limited international payment options

- No invoicing or accounts receivable features

3. ADP RUN: Trusted Payroll Solution

ADP, a global leader in payroll services, offers ADP RUN, a payroll and benefits administration solution tailored for small businesses with room for scalability.

Key Features of ADP RUN:

- Tiered plans with payroll processing by direct deposit

- Self-service employee platform and new hire onboarding

- Optional benefits administration

- Integration with tax form filing and advanced HR tools

Who Should Choose ADP RUN: ADP RUN suits businesses seeking customization options for payroll and benefits, particularly those with plans for growth.

Pros:

- Streamlined employee payroll management

- Automatic tax filing and reporting

- Add-ons for marketing and legal assistance

- Customizable plans

Cons:

- Additional product required for contractor payments

- Added cost for benefits administration and tax form filing

4. Paychex Flex: Simple Payroll for Small Businesses

Paychex Flex offers a simplified payroll platform catering to small businesses with straightforward payroll needs.

Key Features of Paychex Flex:

- Basic payroll processing for employees and contractors

- Integration with Paychex products and third-party accounting systems

- Garnishment payment service included

Who Should Choose Paychex Flex: Small businesses in need of quick and easy payroll processing with flexibility to add additional services as they grow.

Pros:

- Easy employee and contractor payroll processing

- Integration with other Paychex products

- Garnishment payment service

Cons:

- Additional fees for payroll tax filing, W-2, and 1099 filing

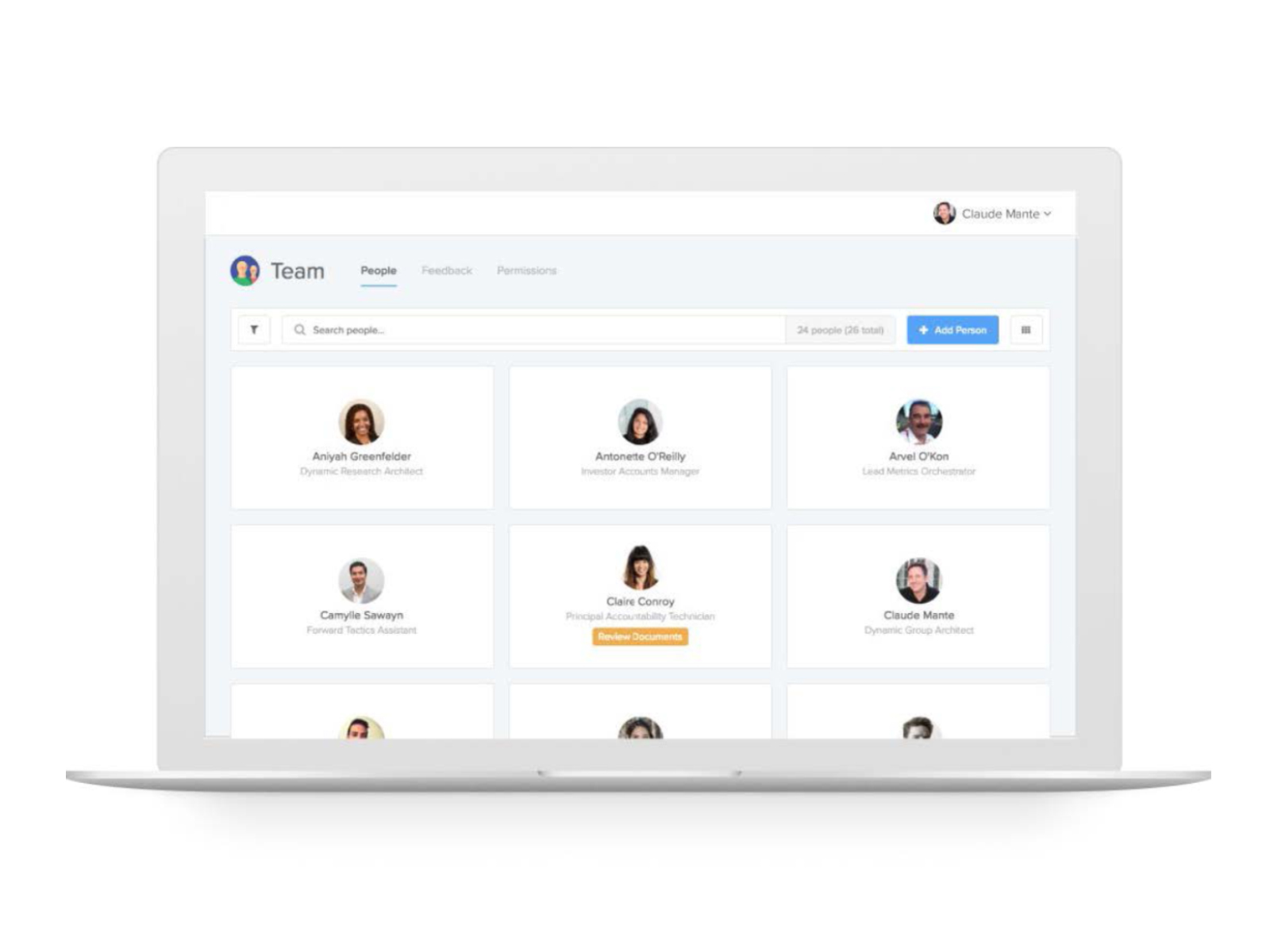

5. Justworks: PEO Solution for Remote Teams

Justworks offers a professional employer organization (PEO) model suitable for remote teams, managing HR and payroll responsibilities.

Key Features of Justworks:

- Co-employment relationship handling HR and payroll on behalf of the employer

- Control of HR duties transferred to Justworks

- Monthly per-employee fee for comprehensive services

Who Should Choose Justworks: PEO solutions like Justworks are ideal for businesses with complex hiring needs and potential business liabilities.

Pros:

- Complete handling of HR duties

- Smooth employee self-service interface

- Reduced employer liability through co-employment relationship

Cons:

- Higher cost compared to software-based solutions

- Some loss of control over HR policies

6. TriNet: Comprehensive PEO Solution

TriNet offers a comprehensive PEO solution, allowing businesses to outsource HR and payroll functions.

Key Features of TriNet:

- Co-employment relationship handling all HR and payroll duties

- Reduction of employer liability through co-employment model

Who Should Choose TriNet: Businesses with complex hiring needs and potential liabilities can benefit from TriNet’s hands-off approach to payroll and HR.

Pros:

- Complete hands-off payroll and HR management

- Reduced employer liability through co-employment

Cons:

- Pricing structure requires additional inquiry

- Limited control over HR policies due to co-employment relationship

7. Wave Payroll: User-Friendly Payroll for Small Businesses

Wave Payroll offers a user-friendly and affordable platform specifically designed for freelancers, contractors, and small business owners.

Key Features of Wave Payroll:

- Integration with accounting, invoicing, and payment processing tools

- Direct deposit for employees and contractors

- Automatic generation of tax forms

- Self-service employee portal

Who Should Choose Wave Payroll: Microbusinesses and solopreneurs with a small team of contractors and part-timers can benefit from Wave’s streamlined payroll services.

Pros:

- Consolidated platform for payroll, accounting, and invoicing

- Intuitive user interface for employers and employees

- Easy payroll processing for various workers

Cons:

- Limited benefits administration

- Automatic payroll taxes available in limited states

RELATED POST:

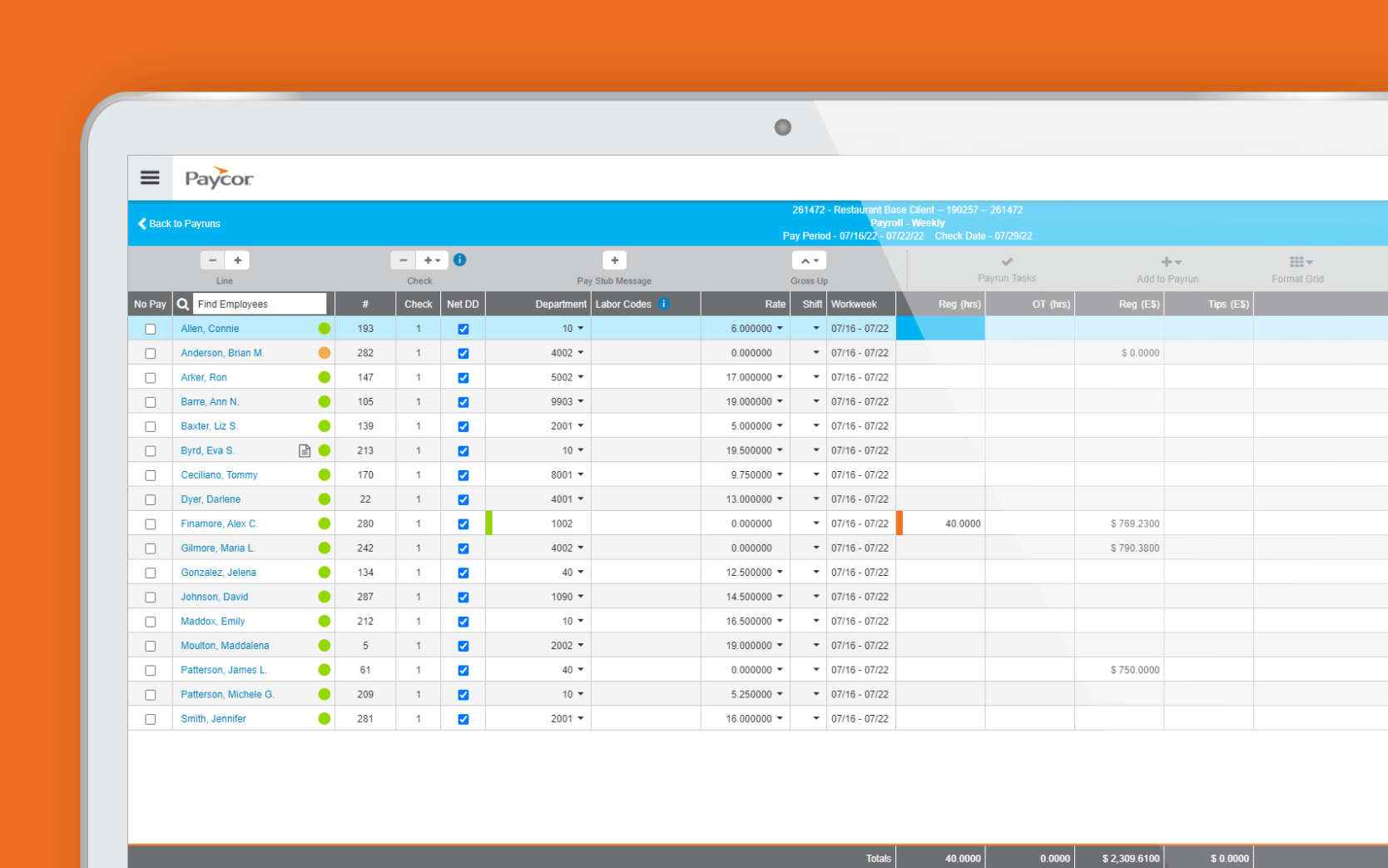

8. Paycor: Full-Service HR Platform

Paycor offers a comprehensive HR platform supporting companies throughout various stages, from recruitment to termination.

Key Features of Paycor:

- Employee portal accessible online and through a mobile app

- Benefits administration available for an extra fee

- Integration with third-party accounting systems

Who Should Choose Paycor: Medium and large businesses with complex HR needs can benefit from Paycor’s extensive range of HR tools.

Pros:

- Easy employee payroll management

- Comprehensive HR tools, including recruitment and performance reviews

Cons:

- Higher cost compared to competitors

- User interface of the employee portal may be clunky

9. Deluxe: Diverse Business Solutions

Deluxe offers a range of services, including marketing, business development, and payroll and HR services.

Key Features of Deluxe:

- Option to integrate HR features with existing payroll provider

- Cloud-based payroll service with packages ranging from basic reporting to robust HR solutions

Who Should Choose Deluxe: Deluxe is suitable for businesses of all sizes, particularly those seeking branding, formation, marketing support, and payroll services.

Pros:

- Integration of marketing and business solutions

- Flexibility to blend existing payroll provider with Deluxe HR

- Streamlined employee payroll management

Cons:

- Additional costs for benefits administration

- Intuitive contractor payment process may be lacking in the interface

In conclusion, choosing the right payroll service is pivotal for small businesses seeking to streamline payroll and HR operations. Each of these nine options offers unique features and advantages, catering to a diverse range of needs and preferences. By selecting the most suitable option, small business owners can efficiently manage payroll while focusing on growing their ventures.