Discovering a credit card with zero interest is like finding a hidden gem in personal finance. It offers a chance to manage expenses without the weight of accumulating debt. In this guide, we unveil the top ten zero interest credit cards, highlighting their unique features and benefits. Join us as we navigate this financial landscape to help you make an informed choice aligned with your goals.

Wells Fargo Active Cash® Card: Maximizing Cash Rewards

Welcome Bonus and Key Details

- Welcome Bonus: $200 Cash Rewards

- Annual Fee: $0

- Regular APR: 20.24%, 25.24%, or 29.99% variable APR

- Credit Score Requirement: Excellent, Good (700 – 749)

Elevate Your Earnings

The Wells Fargo Active Cash Card stands out with its unlimited 2% cash rewards on all purchases. Say goodbye to annual fees and hello to a substantial cash back boost.

Pros:

- Unlimited 2% cash rewards on purchases

- No annual fee

- Cell phone protection benefit

Cons:

- Balance transfer fee applies

- Foreign transaction fee in place

- No travel transfer partners available

Additional Benefits

- Earn a $200 cash rewards bonus after spending $500 in the first 3 months

- 0% introductory APR for 15 months on purchases and qualifying balance transfers, followed by a variable APR

- Enjoy a premium collection of benefits at select prestigious hotel properties with Visa Signature Concierge

- Get up to $600 of cell phone protection when paying your monthly bill with your eligible Wells Fargo card.

READ MORE:

Chase Freedom Flex℠: Unmatched Flexibility

Welcome Bonus and Key Details

- Welcome Bonus: $200 bonus

- Annual Fee: $0

- Regular APR: 20.49% – 29.24% Variable

- Credit Score Requirement: Excellent, Good (700 – 749)

A Versatile Companion

The Chase Freedom Flex card offers a compelling rewards structure without the burden of an annual fee. It’s designed to cater to a wide range of spending categories, including travel, drugstores, and dining.

Pros:

- No annual fee

- Earn 5% rewards in rotating quarterly categories (upon activation) up to a combined quarterly $1,500 maximum

- Competitive rewards rate for travel expenses

- Generous rewards rate in several other categories

Cons:

- 5% cash back for travel requires booking through Chase Ultimate Rewards®

Additional Benefits

- Earn a $200 bonus after spending $500 on purchases in the first 3 months

- Enjoy cash back rewards on various spending categories

- No annual fee ensures cost-effectiveness

Amex EveryDay® Credit Card: Supercharge Your Supermarket Spending

Welcome Bonus and Key Details

- Welcome Bonus: Earn 10,000 points

- Annual Fee: $0

- Regular APR: 18.24% – 29.24% variable

- Credit Score Requirement: Good/Excellent (700 – 749)

Supermarket Enthusiast’s Dream

For those who frequent US supermarkets, the Amex EveryDay® Credit Card is a lucrative choice. Earn points for your regular grocery shopping and enjoy a host of additional benefits.

Pros:

- Possible to earn a 20% bonus on all points earned

- 2 Membership Rewards points per dollar on up to $6,000 spent annually at U.S. supermarkets

- No annual fee

Cons:

- 2.7% foreign transaction fee

- Spending cap on bonus points at grocery stores

- Requires 20 purchases per month to earn the 20% bonus

Additional Benefits

- Earn 10,000 membership rewards points after spending $2,000 in qualifying purchases in the first 6 months

- Use points for eligible charges such as retail, dining, and entertainment

Wells Fargo Reflect® Card: A Balance Transfer Champion

Key Details

- Welcome Bonus: N/A

- Annual Fee: $0

- Regular APR: 18.24%, 24.74%, 29.99% variable APR

- Credit Score Requirement: Excellent, Good (700 – 749)

Balance Transfer Powerhouse

The Wells Fargo Reflect Card offers an extensive introductory APR period for both purchases and qualifying balance transfers, making it an attractive choice for those seeking to manage their balances efficiently.

Pros:

- Generous introductory APR period

- No annual fee

Cons:

- No rewards program or welcome bonus

- Balance transfer fee of 5%; minimum $5

- 3% Foreign transaction fee

Additional Benefits

- Enjoy up to $600 of cell phone protection when paying your monthly bill with your eligible Wells Fargo card.

- Access personalized deals through My Wells Fargo Deals.

Capital One VentureOne Rewards Credit Card: Travel-Friendly Rewards

Welcome Bonus and Key Details

- Welcome Bonus: 20,000 Miles

- Annual Fee: $0

- Regular APR: 19.99% – 29.99% (Variable)

- Credit Score Requirement: Excellent, Good (700 – 749)

Travel Without Boundaries

The Capital One VentureOne Rewards Credit Card is your passport to a world of rewards. With no foreign transaction fees and a range of travel benefits, it’s a great companion for jet-setters.

Pros:

- No foreign transaction fee

- No annual fee

- No penalty APR

Cons:

- Ongoing rewards rate is relatively modest

- Welcome bonus is moderate

Additional Benefits

- Earn a bonus of 20,000 miles after spending $500 on purchases within 3 months

- Enjoy unlimited 1.25X miles on every purchase, every day

U.S. Bank Visa® Platinum Card: A Detailed Review

Introductory Insights

The U.S. Bank Visa® Platinum Card is an excellent choice for those seeking a lengthy introductory APR rate and no annual fees. However, it’s important to note two considerations: a balance transfer fee and the absence of a rewards program. Nevertheless, the savings on interest during the initial period can outweigh the fee.

Pros of the U.S. Bank Visa® Platinum Card

- No Penalty APR: Enjoy peace of mind knowing there’s no penalty APR to worry about.

- Extended Intro APR Period: Benefit from a prolonged introductory APR period.

- Cell Phone Protection Coverage: Avail up to $600 in cell phone protection (subject to a $25 deductible) against damage or theft when you pay your monthly phone bill with your card.

Cons to Consider

- Balance Transfer Fee Applies: Keep in mind that a balance transfer fee is applicable.

- No Rewards Program: Unlike some other cards, the U.S. Bank Visa® Platinum Card does not offer a rewards program.

- No Welcome Bonus: There’s no welcome bonus available.

- Foreign Transaction Fee: Be aware of the foreign transaction fee.

Additional Card Details

- Cell Phone Protection: Receive up to $600 in protection (with a $25 deductible) for damage or theft when you pay your monthly phone bill with the card. Terms, conditions, and exclusions apply.

- Flexible Payment Due Date: Select a payment due date that aligns with your schedule.

- No Annual Fee: Rest easy knowing there’s no annual fee to worry about.

- Introductory APR Offer: Benefit from a competitive introductory APR offer.

RELATED POST:

- Top 10 Help Desk Ticketing Systems of 2023

- Top 10 Call Center Companies of 2023: Revolutionizing Customer Support

- Top 10 Webinar Platforms of 2023

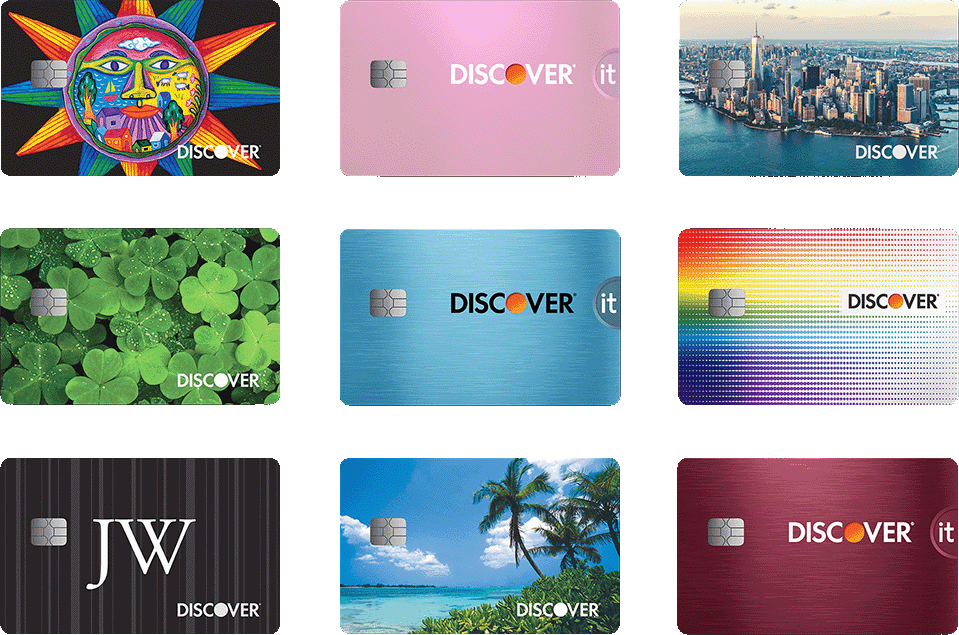

Discover it® Cash Back: Unveiling the Rewards

Welcome to a World of Cash Back

For those who are moderate spenders and willing to activate the 5% rotating categories, the Discover it® Cash Back card offers a lucrative opportunity. This no-annual-fee card not only provides ongoing 1% cash back but also features a unique Cashback Match™ offer.

Advantages of the Discover it® Cash Back Card

- 5% Cash Back on Rotating Categories: Activate quarterly and enjoy 5% cash back on various spending categories throughout the year.

- Cashback Match™: Discover will automatically match all the cash back you’ve earned at the end of your first year, with no minimum redemption amount.

- Flexible Cashback Redemption: Enjoy versatile options for redeeming your cash back.

Points to Keep in Mind

- Quarterly Spending Cap: Note that the 5% bonus cash back rate is limited to $1,500 per quarter in spending.

- Activation Required: Remember to activate the bonus categories quarterly.

- Base Reward Rate: Outside of bonus categories, the card offers a 1% base reward rate on all purchases.

Further Insights into the Card

- Unlimited Cashback Match: Discover will automatically match all the cash back you’ve earned at the end of your first year, with no restrictions on earnings.

- Rotating Categories: Earn 5% cash back on everyday purchases at different places each quarter, including Amazon.com, grocery stores, restaurants, and gas stations, up to the quarterly maximum when you activate. Additionally, receive unlimited 1% cash back on all other purchases.

- Enhanced Privacy Protection: Discover can assist in reducing your online exposure by helping you remove your information from select people-search sites. This service is free and can be activated via the mobile app.

- Introductory APR Offer: Enjoy a 0% intro APR for 15 months on purchases, followed by a variable APR based on creditworthiness.

- No Annual Fee: Rest assured, there’s no annual fee associated with this card.

Discover it® Chrome: A Closer Look

:max_bytes(150000):strip_icc()/discover-it-chrome-credit-1b0a1ef5030b475ebbd2abe11c2032dc.jpg)

The Unique Features of Discover it® Chrome

The Discover it® Chrome card offers a distinct 1-for-1 cash back match, effectively doubling your rewards at the end of the first year. While this is a standout feature, it’s essential to consider the limitations associated with the 2% bonus cash back category.

Noteworthy Advantages

- Cash Back Match: Double your rewards at the end of the first year with this generous feature.

- Flexible Cash Back Redemption: Enjoy various options for redeeming your cash back.

- No Foreign Transaction Fee: Travel without worrying about foreign transaction fees.

Points to Consider

- Balance Transfer Fees: Be aware of the high balance transfer fees associated with this card.

- Cash Advance Fee: Keep in mind the high cash advance fee.

- Category Spending Limit: The 2% cash back category is limited to the first $1,000 in quarterly spending.

- Base Rate on Other Purchases: All other purchases earn a 1% cash back rate.

Additional Insights

- Unlimited Cashback Match: Discover will automatically match all the cash back you’ve earned at the end of your first year, without any restrictions.

- Earn Cash Back on the Go: Get 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter. Plus, enjoy unlimited 1% cash back on all other purchases.

- Enhanced Privacy Protection: Discover can assist in reducing your online exposure by helping you remove your information from select people-search sites. This service is free and can be activated via the mobile app.

- Introductory APR Offer: Enjoy a 0% intro APR for 15 months on purchases, followed by a variable APR based on creditworthiness.

- No Annual Fee: Rest assured, there’s no annual fee associated with this card.

Citi Simplicity® Card: Embracing Simplicity

Simplifying Your Financial Journey

The Citi Simplicity Card offers an extensive intro APR offer for balance transfers, making it an attractive option for those aiming to manage their balances effectively. However, it’s important to note the fee associated with each transfer.

Advantages of the Citi Simplicity® Card

- No Late Fees: Enjoy the benefit of no late fees.

- No Penalty APR: Rest easy knowing there’s no penalty APR.

- No Annual Fee: Keep your finances streamlined with no annual fee.

- Intro APR Offers: Benefit from introductory APR offers on both purchases and balance transfers.

Points to Keep in Mind

- Regular APR: Be aware of the higher regular APR associated with this card.

- No Rewards Program: Unlike some other cards, the Citi Simplicity® Card does not offer a rewards program.

Additional Card Details

- No Late Fees or Penalty Rates: Experience the freedom of no late fees or penalty rates.

- Fraud Early Warning: Enjoy added security with no liability on unauthorized charges and early fraud warnings.

- No Annual Fee: Rest assured, there’s no annual fee associated with this card.

Chase Freedom Unlimited®: A Comprehensive Overview

Your Gateway to Financial Freedom

The Chase Freedom Unlimited® card is an excellent choice for those seeking flexibility in managing their balances, along with the opportunity to earn cash back rewards. It combines a low introductory APR, no annual fee, and competitive cash back rates.

Advantages of the Chase Freedom Unlimited® Card

- Generous Welcome Offer: Enjoy a welcome offer of up to $300 cash back, a noteworthy advantage for a no-annual-fee card.

- Minimum 1.5% Cash Back: Earn a minimum of 1.5% cash back on all purchases, providing consistent rewards.

- No Minimum Redemption Amount: Enjoy the flexibility of redeeming your cash back without any minimum requirements.

Points to Consider

- Foreign Transaction Fee: Keep in mind the foreign transaction fee.

- Ongoing Balance Transfer Fee: Be aware of the fee associated with ongoing balance transfers.

- Companion Card for Travel Points: Note that a companion card is required to transfer points to travel partners.

Additional Insights

- Additional Cash Back Offer: Earn an additional 1.5% cash back on all purchases (up to $20,000 spent in the first year), worth up to $300 cash back.

- Cash Back on Travel and More: Enjoy cash back on travel, drugstore purchases, and dining at restaurants. Plus, earn cash back on all other purchases.

- Flexible Redemption Options: Choose between a statement credit or direct deposit into most U.S. checking and savings accounts for cash back rewards.

- Introductory APR Offer: Enjoy a 0% intro APR for 15 months on both purchases and balance transfers, followed by a variable APR based on creditworthiness.

- No Annual Fee: Rest assured, there’s no annual fee associated with this card.

- Credit Health Monitoring: Utilize Chase Credit Journey to monitor your credit health with free access to your latest score, real-time alerts, and more.

Conclusion

In the world of personal finance, zero interest credit cards offer a vital respite from mounting debt. Each of the top ten options we’ve explored presents unique advantages, catering to various financial needs. Choose wisely based on your circumstances, spending habits, and goals.

Remember, responsible card use is paramount. Make timely payments and stay within your means. With the right approach, a zero interest credit card can be a powerful ally in your pursuit of financial stability.